When Canadian fast food chain A&W added plant-based burgers to the menu, they sold out in several locations on the first day, with some restaurants reporting higher sales of the vegan Beyond Burger than beef burgers.

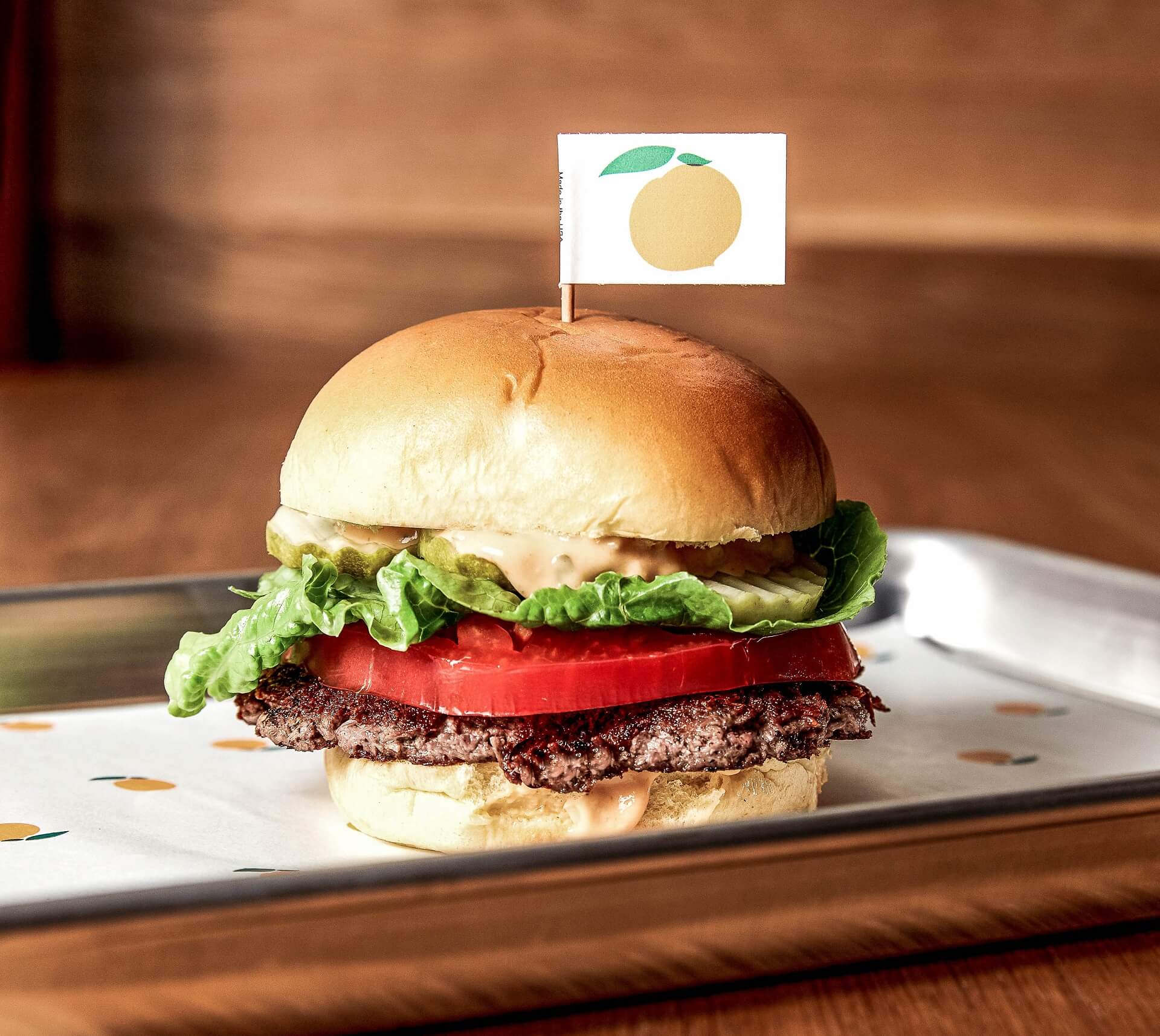

Image: Impossible Foods

Since gourmet US burger chain Umami Burger started carrying the Impossible Burger in 2017, it’s grown to be the number one driver of new sales chainwide, now accounting for one third of all burger sales.

Even more dramatically in Finland, sales at burger chain Bun2Bun grew 400% when the brand decided to ditch all its beef-based burgers in favour of an all-vegan menu centred around the Beyond Burger.

And this is just the tip of the iceberg. Plant-based burgers, which look, taste, sizzle and even bleed like the real thing, have been flying off the supermarket shelves in Europe, the US and Asia since they started hitting the market in 2016.

As well as appealing to vegans and vegetarians, these planet-friendly patties, which are produced with a fraction of the environmental impact of beef burgers, are proving popular with the growing proportion of consumers who identify as flexitarian.

At present, 39% of Americans are actively trying to incorporate more plant-based foods into their diets, with millennials driving this shift. 30% eat meat alternatives every day and 50% a few times a week, according to 2017 research by Nielsen.

Image: Impossible Foods

Marketing hype

Sascha Barby, senior director of Global Culinary Experts at Rational, says that although the price of plant-based burgers and high-qualitybeef patties is currently about the same, the marketing hype surrounding meat-free burgers makes them an attractive financial proposition for restaurant operators.

“Plant-based burgers are cheap to promote because they’re new to the market and as they mimic meat and manipulate your taste buds, they’re thrilling to lots of people,” he says.

His advice to chefs is to sell plant-based burgers for the same price as beef burgers, reflecting the value of the product.

Meanwhile, the key to marketing these products successfully – according to the World Resources Institute’s Better Buying Lab, which has been researching the kind of language that works to boost sales of plant-rich menu items for the past two years – is steering clear of terms like ‘meat-free’, ‘vegan’ and ‘vegetarian’ and ‘low fat’.

Instead, operators are advised to highlight the products’ provenance, spotlight their flavour, and emphasise their look and feel.

Image: Rational AG

Bringing costs down

Plant-based burger companies are producing their patties at relatively low quantities at present, but as they scale up and costs come down – at the same time as consumer awareness of the impact their meat intake has on their health, the environment and animal welfare continues to grow – the business case for putting meat-free burgers on the menu will only become more attractive.

For example, Impossible Foods, which currently sells its plant-based burger at $13.95, reduced its key inputs cost by 40% during 2017, and plans to drive the price of its product below that of Safeway’s 80/20 hamburger meat.

It’s no wonder Lux Research is predicting plant-based protein could present one-third of the overall protein market by 2054.